Advertiser Disclosure: SuperOffers.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, SuperOffers.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

Terms apply to American Express offers on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

What We'll Cover

- Elevate Your Travel Experience with the American Express Platinum Card

- Card Features

- Rewards Program

- Fees and Rates

- Pros and Cons of the American Express Platinum Card: Is it Right for You?

- Choosing the Best Travel Credit Card: Comparing the American Express Platinum Card with Its Competitors

- How to Get the Most Out of Your American Express Platinum Card Benefits

- Who Should Apply for the Card: Recommendations and Tips

- FAQs About the American Express Platinum Card

- Final Thoughts

Elevate Your Travel Experience with the American Express Platinum Card

If you're looking for a credit card that offers luxury benefits and exclusive perks, the American Express Platinum Card may be the perfect fit for you. This high-end card offers a variety of unique benefits and features that set it apart from other credit cards on the market.

Card Features

| Benefit | Description |

|---|---|

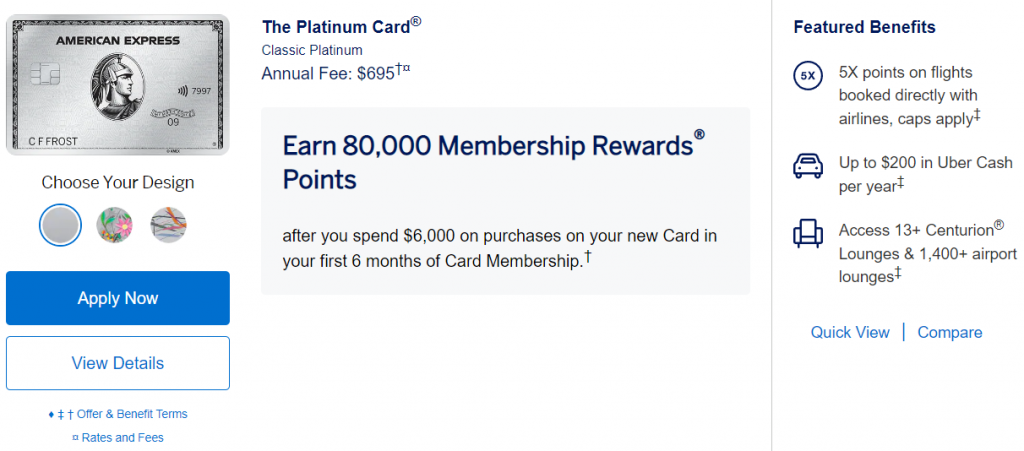

| Welcome bonus | During the first six months of card membership, spend $6,000 on purchases with your new card to receive 80,000 Membership Rewards points. |

| Airline fee credit | Receive statement credits of up to $200 per fiscal year for incidental charges made to your card account by a single carrier, such as those for checked baggage and onboard refreshments. |

| Lounge access | The American Express Global Lounge Collection offers access to more than 1,400 lounges in 650+ cities and 140+ countries around the globe. |

| CLEAR Plus credit | Get up to $189 in statement credits annually for a CLEAR Plus membership, which lets you pass through security more quickly at some U.S. venues and airports by giving you a touchless ID based on your biometrics. |

| Fine Hotels + Resorts/The Hotel Collection | On prepaid reservations made through American Express Travel for Fine Hotels + Resorts or The Hotel Collection, you will receive $200 back in statement rewards each year. Additionally, take advantage of freebies like a $100 experience credit, a daily breakfast for two, and upgraded rooms when they become available at each location. |

| Entertainment credit | On one or more of the following: Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The Wall Street Journal, you can receive up to $20 back each month on eligible transactions made with your card. |

| Walmart+ membership credit | When you use your card to pay for a monthly Walmart+ membership, you will receive a statement credit for the entire amount for each month ($12.95 plus any relevant local sales tax). |

Rewards Program

A generous rewards program offered by the American Express Platinum Card enables cardholders to accrue Membership Rewards points for each transaction. You can exchange these points for trips, purchases, or statement credits.

Fees and Rates

As a premium credit card, the American Express Platinum Card does come with a high annual fee of $695 (as of March 2023) (See Rates & Fees). The card also has a foreign transaction fee of 0%, making it a good option for frequent international travelers. The APR for Cash Advances is 21.24% - 29.24%.

Pros and Cons of the American Express Platinum Card: Is it Right for You?

- Access to airport lounges and hotel upgrades

- Opportunities to earn a lot of points on travel-related purchases

- High annual fee

- The rewards program may not be as valuable for those who don't travel frequently

Choosing the Best Travel Credit Card: Comparing the American Express Platinum Card with Its Competitors

When compared to other premium credit cards like the Chase Sapphire Reserve and the Citi Prestige Card, the American Express Platinum Card offers a more extensive list of benefits and perks. However, these cards may have lower annual fees and more flexible rewards programs.

How to Get the Most Out of Your American Express Platinum Card Benefits

To make the most of the American Express Platinum Card, it's important to take advantage of the exclusive benefits and rewards program. This means using the card for travel-related purchases and making sure to activate and use the various credits that come with the card. It's also important to keep track of the annual fee and make sure that the value of the benefits outweighs the cost.

Who Should Apply for the Card: Recommendations and Tips

The American Express Platinum Card is a good fit for frequent travelers who value luxury perks and benefits. To maximize the value of the card, it's important to use it for travel-related purchases and take advantage of the various credits and benefits that come with it. If you don't travel frequently or don't think you'll use the exclusive benefits, there may be better credit card options for you.

FAQs About the American Express Platinum Card

What is the credit limit for the Card?

The credit limit for the American Express Platinum Card is determined based on the cardholder’s credit history and financial standing.

Does the American Express Platinum Card offer travel insurance?

Yes, the American Express Platinum Card offers a variety of travel insurance benefits, including trip cancellation and interruption insurance, travel accident insurance, and more.

What credit score do I need to qualify for the American Express Platinum Card?

To be approved for the American Express Platinum Card, you generally need a good to excellent credit score (usually 700 or higher).

Does the American Express Platinum Card have foreign transaction fees?

No, the American Express Platinum Card does not have foreign transaction fees.

What is the difference between the American Express Platinum Card and the American Express Gold Card?

While the two cards share some similarities, the Platinum Card offers more travel perks and a higher rewards earning rate, but comes with a higher annual fee.

Final Thoughts

Overall, the American Express Platinum Card is a great option for frequent travelers who value luxury experiences and want to earn flexible rewards points. While the card’s high annual fee may be a deterrent for some, the card’s travel perks and rewards program can more than make up for it for the right user. Before applying, it’s important to carefully consider your spending habits and travel needs to determine if the card is the right fit for you.

For Rates & Fees of:

- The Platinum Card® from American Express Click Here

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

To find all the details about the terms and conditions of an offer, check the online credit card application. We put a lot of effort to present you accurate and up-to-date information; however, we do not guarantee the accuracy of all credit card information presented.

Editorial Disclosure: All reviews/opinions expressed here are author's alone, and have not been reviewed, approved, or otherwise endorsed by any advertiser included within our content. The information presented on this page is accurate as of the posting date; however, some of the offers mentioned below may have expired. Check the issuer's website for the most recent information.

Advertiser Disclosure: SuperOffers.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, SuperOffers.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.