Advertiser Disclosure: SuperOffers.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, SuperOffers.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

Terms apply to American Express offers on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

What We'll Cover

- American Express Gold Card - Elevating Your Spending Game

- Unpacking the Luxurious Benefits of the American Express Gold Card

- Getting the Most Out of Your American Express Gold Card Rewards

- How the American Express Gold Card’s Fees and Rates Measure Up

- Pros and Cons of the American Express® Gold Card

- How the American Express® Gold Card Stacks Up Against Other Premium Credit Cards

- Unlocking the Full Potential of Your American Express Gold Card

- Is the American Express Gold Card Right for You? Here’s What You Need to Know

- Frequently Asked Questions About the American Express Gold Card, Answered

- Final Thoughts on the American Express Gold Card - Is It Worth It?

American Express Gold Card - Elevating Your Spending Game

The American Express® Gold Card is a high-end credit card that offers a range of benefits and rewards for its users. With its impressive array of features, this card is an excellent choice for those who want to earn rewards on their everyday purchases.

Unpacking the Luxurious Benefits of the American Express Gold Card

The American Express Gold Card comes with a host of features that make it a great choice for frequent travelers and foodies. Some of the key features of this card include:

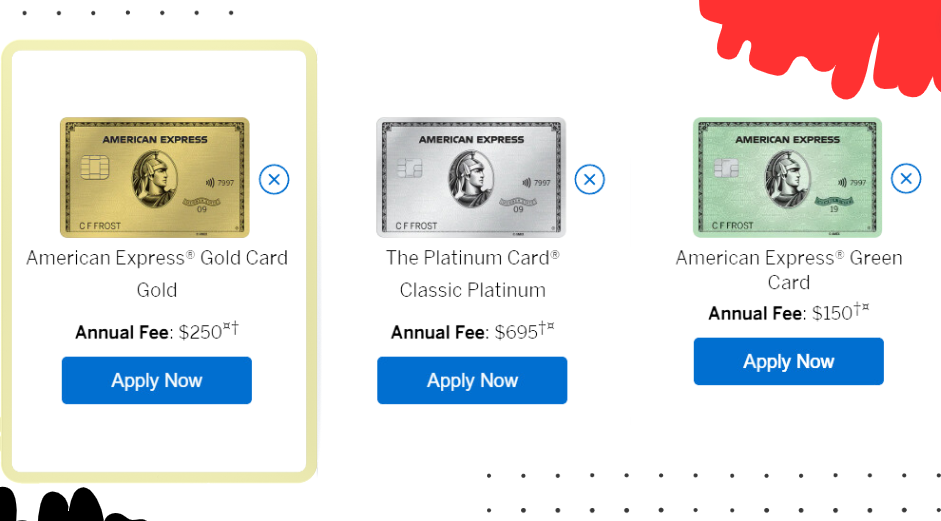

- Annual Fee: $250 (See Rates & Fee)

- 4x Membership Rewards points at U.S. supermarkets (up to $25,000 in purchases per year, 1X thereafter)

- 4x Membership Rewards points at restaurants worldwide

- 3x Membership Rewards points on flights booked directly with airlines or on amextravel.com

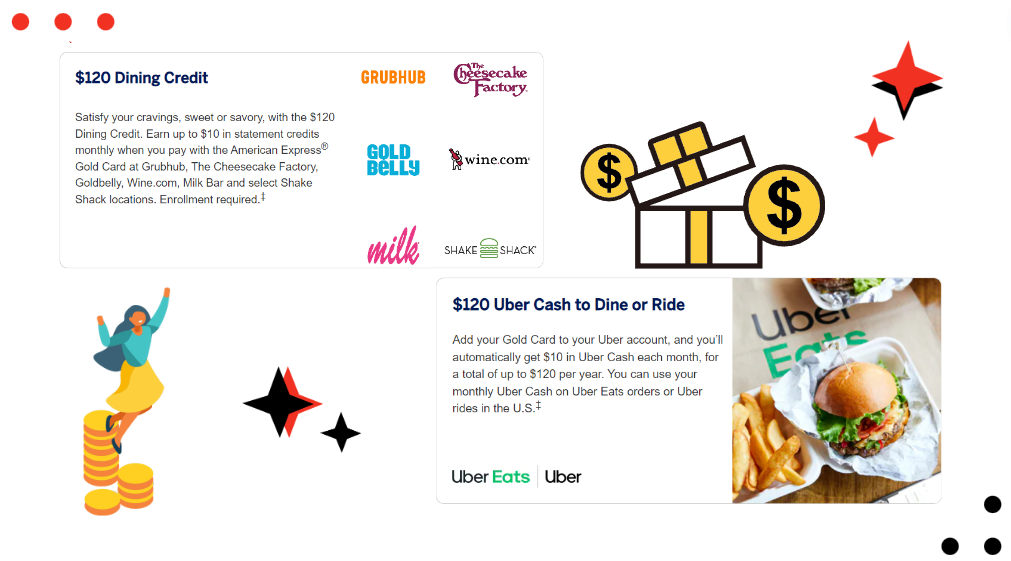

- Up to $120 per year in dining credits at select restaurants and food delivery services, is credited as $10 per month

- Up to $120 per year in Uber Cash for Uber rides or Uber Eats orders in the U.S., is credited as $10 per month

- No foreign transaction fees. (See Rates & Fee)

Getting the Most Out of Your American Express Gold Card Rewards

The American Express Gold Card rewards program is one of the best in the market, offering generous rewards on a variety of purchases. Cardholders can earn Membership Rewards points on every purchase they make, and these points can be redeemed for a range of rewards, including:

- Travel bookings

- Merchandise

- Gift cards

- Statement credits

- Donations to charity

Tips on how to maximize rewards and earn the most points:

- Use the card for everyday purchases, such as groceries and dining out

- Book flights directly with airlines or through amextravel.com

- Take advantage of the card's dining credits and Uber Cash offers

How the American Express Gold Card’s Fees and Rates Measure Up

The American Express Gold Card has a range of fees and rates, including:

- Annual fee: $250

- Foreign transaction fee: None

- Late payment fee: up to $40 (See Rates & Fee)

- APR: Variable APR of 21.24% - 29.24%

Pros and Cons of the American Express® Gold Card

- Generous rewards program

- Dining and Uber credits

- No foreign transaction fees

- Travel benefits, such as baggage insurance and roadside assistance

- High annual fee

- Limited redemption options for points

- Some benefits are only available in certain locations

How the American Express® Gold Card Stacks Up Against Other Premium Credit Cards

Compared to other credit cards in the market, the American Express Gold Card stands out for its rewards program and benefits. However, its high annual fee may make it less appealing for some users. Other cards to consider include:

Chase Sapphire Reserve®

The Chase Sapphire Reserve® is another high-end travel rewards card with a $550 annual fee. However, it offers a higher sign-up bonus of 60,000 points (worth $900 in travel rewards), and a higher rewards rate of 3x points on travel and dining. The card also offers a $300 annual travel credit and a Priority Pass Select membership for airport lounge access. However, the card has a higher minimum credit limit of $10,000, and the points earned on the card cannot be transferred to as many travel partners as the American Express Gold Card. Overall, the Chase Sapphire Reserve® may be a better option for frequent travelers who value airport lounge access and higher rewards on travel and dining.

Citi Prestige Credit Card

The Citi Prestige Credit Card is another premium travel rewards card with a $495 annual fee. The card offers a sign-up bonus of 50,000 points (worth $800 in travel rewards), and a rewards rate of 5x points on air travel and restaurants, 3x points on hotels and cruises, and 1x points on all other purchases. The card also offers a $250 annual travel credit, a Priority Pass Select membership, and a 4th night free benefit on hotel stays booked through Citi. However, the card has a higher minimum credit limit of $15,000, and the points earned on the card cannot be transferred to as many travel partners as the American Express Gold Card. Overall, the Citi Prestige Card may be a better option for frequent travelers who value higher rewards on air travel and restaurants, as well as the 4th night free benefit on hotel stays.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a mid-tier travel rewards card with a $95 annual fee (waived for the first year). The card offers a rewards rate of 2x miles on all purchases. The card also offers a Global Entry or TSA PreCheck application fee credit, and the ability to transfer miles to a variety of travel partners. However, the card does not offer the same level of premium benefits as the American Express Gold Card, such as the dining and Uber credits, and it has a lower rewards rate on dining and travel. Overall, the Capital One Venture Rewards Credit Card may be a better option for occasional travelers who value a lower annual fee and the ability to transfer miles to a variety of travel partners.

Unlocking the Full Potential of Your American Express Gold Card

To get the most out of the American Express Gold Card, use it for everyday purchases, such as groceries and dining out. Take advantage of the card's dining and Uber credits, and book flights directly with airlines or through amextravel.com to earn more points. Be sure to pay your bill on time and in full to avoid late payment fees and interest charges.

Is the American Express Gold Card Right for You? Here’s What You Need to Know

We recommend the American Express Gold Card for users who:

- Spend a significant amount on groceries and dining out

- Travel frequently

- Want to earn rewards on their everyday purchases

To get the most out of the card, use it for everyday purchases, take advantage of the dining and Uber credits, and book flights directly with airlines or through amextravel. Additionally, be sure to pay your balance in full and on time each month to avoid accruing interest charges and late fees.

Frequently Asked Questions About the American Express Gold Card, Answered

Q: Is the American Express Gold Card worth the annual fee?

A: The value of the Gold Card depends on your spending habits and lifestyle. If you frequently dine out, travel, and spend in categories that earn bonus points, then the card can provide significant value. However, if you don't use the card often or prefer a card with no annual fee, then the Gold Card may not be worth it for you.

Q: Can I transfer my American Express Membership Rewards points to airline or hotel loyalty programs?

A: Yes, American Express Membership Rewards points can be transferred to a variety of airline and hotel loyalty programs, including Delta SkyMiles, Marriott Bonvoy, and Hilton Honors, among others.

Q: Are there any foreign transaction fees with the American Express Gold Card?

A: Yes, the Gold Card has a foreign transaction fee of 2.7% on all purchases made outside of the United States.

Final Thoughts on the American Express Gold Card - Is It Worth It?

Overall, the American Express Gold Card is an excellent option for those who frequently dine out, travel, and spend in categories that earn bonus points. With a generous rewards program, valuable benefits, and a stylish design, the Gold Card is a great choice for those who want to get the most out of their credit card. However, it's important to note that the card does come with a high annual fee and foreign transaction fees, so it may not be the best fit for everyone. We hope this review has helped you make an informed decision about whether or not the American Express Gold Card is right for you.

For Rates & Fees of:

-American Express® Gold Card Click Here

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

To find all the details about the terms and conditions of an offer, check the online credit card application. We put a lot of effort to present you accurate and up-to-date information; however, we do not guarantee the accuracy of all credit card information presented.

Editorial Disclosure: All reviews/opinions expressed here are author's alone, and have not been reviewed, approved, or otherwise endorsed by any advertiser included within our content. The information presented on this page is accurate as of the posting date; however, some of the offers mentioned below may have expired. Check the issuer's website for the most recent information.

Advertiser Disclosure: SuperOffers.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, SuperOffers.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.